This is an economic analysis of the corona impact at the market place, how it could affect many of us and how to gear up for the post corona world …

This is just the financial / economical persepctive … There are many other perspectives including healthcare, psychological welfare and so on …

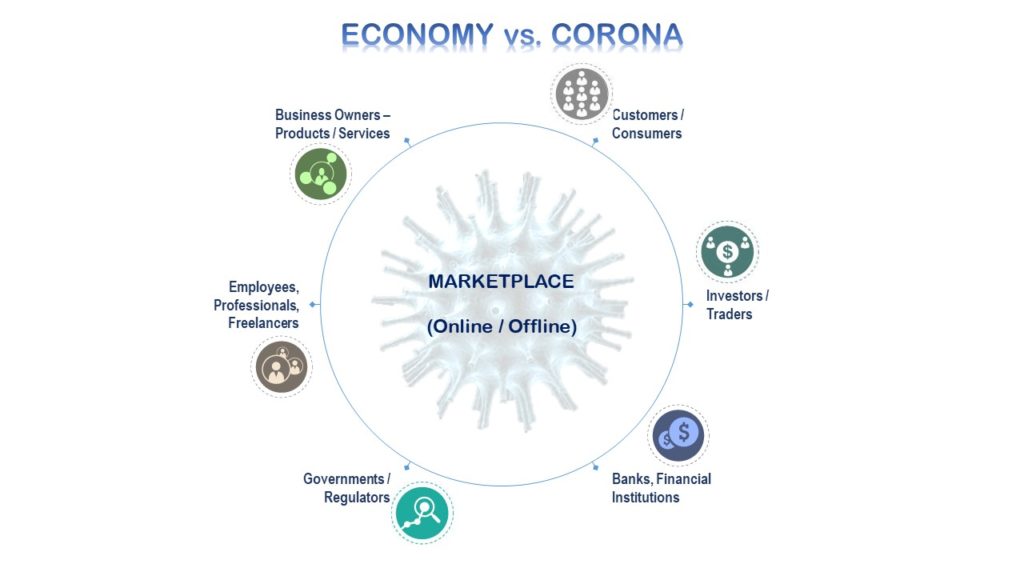

Overall its a real bad time for most markets across the Globe. Corona has spared very few economies. Be it a man made disaster or the aftermath of disturbing the ecosystem balance – the outcome is an impact on everyone’s finances and future plans. Corona has changed the marketplace completely for all the participants.

Financial Impact on Entire System

Let’s brief the impact on each of the stakeholders in detail:

- Employees, Professionals, Freelancers > Unfortunate employees like daily wagers, contractors etc. might be staring at a sudden loss of survival income and they’ll be forced to eat up from whatever little savings or buffers they have, unless the Government steps in with adequate welfare schemes that directly benefit the lowest level. Fortunate employees might still be in employement, but staring at a pay-cut, potential layoff in near future and so on – this risk is higher if your sector is directly hit by Corona (e.g., tourism) or your work is treated as a discretionary (nice to have) kind of work by the employer or the employer’s end customer.

- Business Owners – Products / Services > Business owners will soon face a rapid decline in cash inflows and debtor payments due to the systemic impact of the crisis. But most of the business expenses and overheads are likely to remain the same. This is likely to be the case irrespective of domestic or foreign customer base. Is the future bleak?

- Investors / Traders > Investors and/or traders will see a historical low of their portfolios with little help from existing analysts or calculators. This is a one off black swan event which could wipe out some of the scrips in your portfolio. How will you be able to cope up with this situation?

- Customers / Consumers > End consumers will be vary to spend with overall negative emotions and fear of meeting essential needs. They’ll try to spend only on the most essentialities and cut of all nice to have items. They might also have a behavioural change to move to a greener, e-mode of operations

- Banks, Financial Institutions > All lenders will be looking at a sudden NPA (bad loan) spike in their books due to the impact on the cashflows of their customers. They’ll also face demands for moratorium, restructuring from customers and authorities – leading to a cut in bottomline atleast for several quarters to come.

- Governments / Regulators > All authorities will be tasked with effective rebalancing of the financial system to rejuvenate growth. They’ll need to work out financial stimulus and incentive packages to revive business confidence. They’ll also need to run a tight show with delay receivables and extension of many regulatory payment deadlines like GST,TDS,MCA compliances etc

Proactive Measures

While Corona came un-stoppable across the Globe, we can do much better in being prepared for the post Corona world and the risks we detailed above.

- Employees, Professionals, Freelancers > Assess your employers or companies portfolio and understand how the customers are going to contribute to your topline going forward. Will they be affected severely by Corona that it’ll ultimately affect your take home? Will there be customer behavioural changes that will take them out to better offerings? Any impact to your company’s topline could come in as a pay-cut or lay off for you. So up-skill and be ready for a switch, if it comes to that. Another measure that can be looked at is to take job loss insurance which can cover your rental payments and EMI payments for around 6 months or so (insurance companies like HDFC Ergo has such offerings). Most important thing is to have a budget matching your inflow and outflow. Make sure to prepare it for the worst case scenario. Also look at building alternate sources of revenue through extra freelancing, income for your partner and so on.

- Business Owners – Products / Services > This is your time to revamp the business and have a fresh look at it. Try and conduct a Design Thinking workshop with your key team to reimagine the business. Is there a better way of achieving my business outcomes at a lesser cost? Analyse and find out if all your current customers will remain post Corona as well. Especially relevant for exporters who export to Corona hit countries. Cashflow planning is another activity that you need to do to make sure that you make the ends meet – negotiate with your property landlords to see if rent can be waived off or reduced for some months, see if you can introduce a pay-cut across employees if you don’t have enough buffer (any pay-cut must start with you and remember pay-cut is better than lay offs). Also try and influence favourable decisions from authorities by lobbying at industry body levels and associations.

- Investors / Traders > Average out vs. limit losses will be the fight for you. Evaluate your portfolio and see if the business will stay relevant at its strength post Corona. If so, it makes sense to average out. Also, this is the best time to enter many strong stocks as they have taken a beating with Corona crisis (while their inherent strength still remaining intact). See this illustration of the historical Nifty P/E ratio to understand why this is the best time to enter the market.

- Banks, Financial Institutions > Banks will need to re-assess their underwriting and credit assessment guidelines to identify strong borrowers to lend to in future. They need to also invest in their FinTech capabilities to cache in more relevant customers

In conclusion, Corona is presenting one of the best times for new entrepreneurs and industries to come to the market without any baggage, it is giving one of the best times for individuals to upskill themselves while being at home and it is paving a cheap entry to many strong stocks and funds in the market. Understand, evaluate and identify your best bets – take help of your financial advisors to vet the decisions and stay relevant post Corona.