Tom (not real name) was a customer who got in touch with us through

Tom and his wife are working in the aviation sector and is employed with a public sector company. They are planning to purchase a flat in Kolkatta (as it’s their native place) and wanted to plan it well to optimize on their outgo and derive maximum tax benefits. So our management consultant partner got involved and developed a financial model ‘Numbers for Decisioning’ that can help Tom take an informed decision.

Purchase of a flat requires optimum planning of tax numbers (both interest and principal outgo) to make sure that you minimize the financial burden in the long term

What are the key considerations for taking a home loan?

Following are the major questions that we wanted to address, to enable Tom to take the

- How to arrive at the ideal agreement value for the transaction?

- In whose name the loan is to be taken – Single or Joint?

- What are the tax benefits associated with the loan and how to use it to the maximum?

- Does Tom need to make any change in his current investment patterns?

- How to choose the right loan provider?

- How to choose the ideal loan product type from the options available?

Each choice in life has its consequences and for an event like

purchase of house/flat, a well informed decision is necessary to avoid the adverse financial repercussions in future

How did our advisory service help Tom ?

Our Advisory Partner wanted to enable Tom to take decisions on his own and as far as possible we wanted the decisions to be driven by numbers so that he gets it right the first time. We call it ‘Numbers for Decisioning’ as it removes any emotional and peer biases from the decision-making process and makes it objective for the decision maker. Ultimately it helps

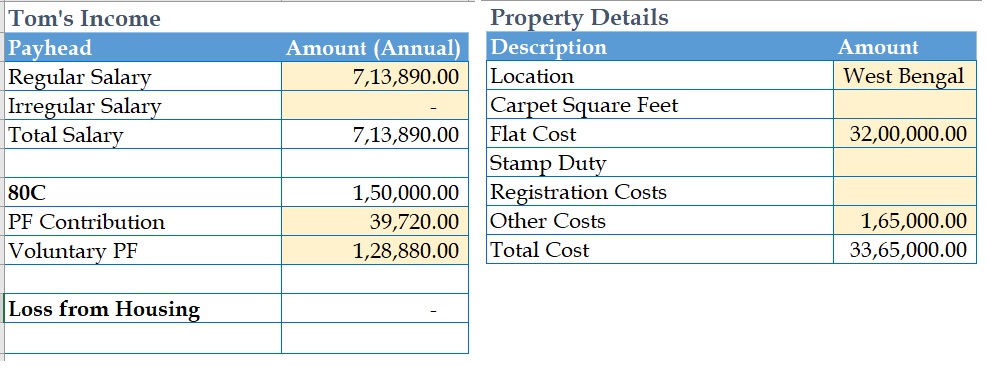

We started with Tom’s Income (salary in this case) and the details of the property in consideration. We confirmed with Tom that his wife’s income is more or less same as his income and both of them belong to the same tax bracket.

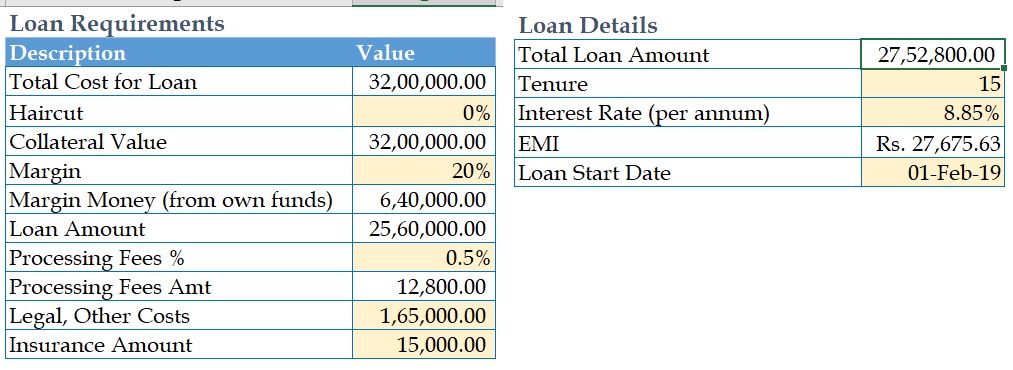

Now based on the property details, we computed the loan requirements and loan details.

In all of the above tables in the financial model, the only fields to enter are the light orange colored cells. Once those values are entered, all the other fields get computed based on defined logic in the model. Now based on the loan details in Table 4, the amortization schedule was plotted for the defined tenor (this must be a value comfortable for the beneficiary and must ensure closing the loan during his earning age itself).

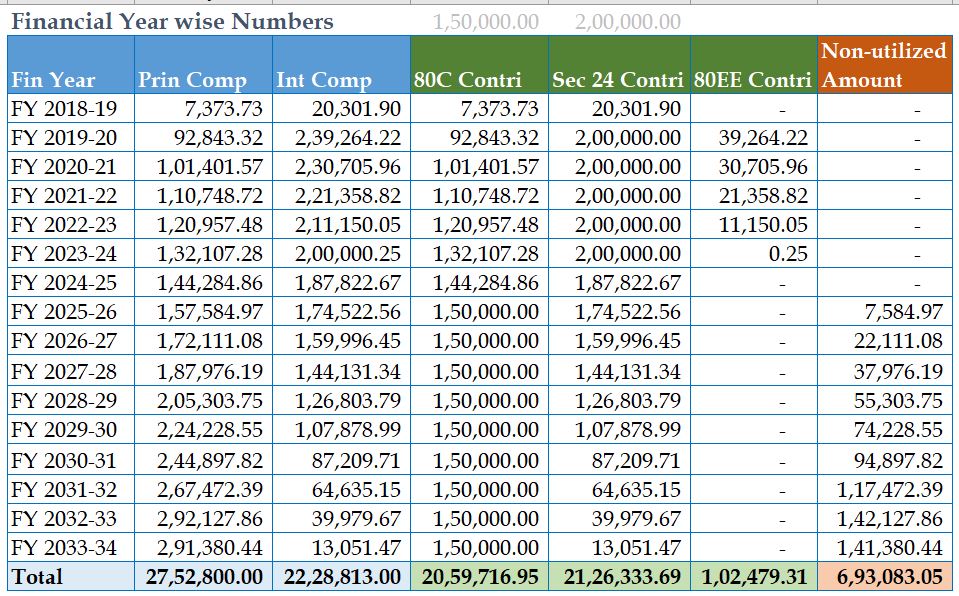

Based on the amortization schedule a table with the total interest and principal outgo in each financial year is computed. A representation of the utilization of the cash outflow in tax benefits is also shown in the table.

‘Numbers for Decisioning’ is one of the most preferred decision-making

method as it takes away the biases from decisions and makes it as objective as possible

What were our recommendations to Tom?

We gave this financial model (created in Microsoft Excel) to Tom as it will enable him to take decisions associated with his multiple loan and property options. All he needs to do is to plug-in the values from Builder / Bank and the model will give him numbers required for taking his decisions. Following are the recommendations that we gave to Tom for the questions that we started with.

How to arrive at the ideal agreement value for the transaction?

Most ideal agreement value for the transaction will be the full cost of the property as it’ll give you no headaches in future and is completely legal in all aspects. Many banks have defined threshold agreement value for deciding the margin money (E.g., Above 30 Lakhs – 20% margin money, else 10% margin money).

In whose name the loan is to be taken – Single or Joint?

Three options are available regarding the ownership of the loan: 1) In Tom’s name, 2) In Wife’s name, 3) Joint ownership. Since this is their first home and the transaction & loan amounts are in the eligible range, they both can avail Sec 80EE benefit and claim additional Rs.50,000 exemption.

What are the tax benefits associated with the loan and how to use it to the maximum?

Tax benefits associated with the Interest and Principal components of the loan is detailed in

Table 6: Financial Year wise Numbers, which helped Tom understand the tax benefits for the future years as well.

Does Tom need to make any change in his current investment patterns?

Table 1: Income Details highlights investment in Voluntary PF (VPF) which fills the Sec 80C benefits. We advised Tom to reduce this VPF contribution as Principal outgo increases in the coming years (as principal can claim the 80C benefit) and look at other retirement corpus plans available in the market as well.

How to choose the right loan provider?

Enquire loan options from multiple banks, especially from your Salary account bank. Plug in the details of loans in Table 4: Loan Details. Now Table 6: Financial Year wise Numbers will give you the total interest and capital outgo. Add on the processing and other fees associated to arrive at the total cost of the loan for a given tenure. Whichever bank offers loan at the least cost – choose them.

How to choose the ideal loan product type from the options available?

Its prudent to choose the best of the available products that the bank has, as future switching of products/schemes will involve additional costs. We advised Tom to look for Home Loan with Overdraft products as this lets you park the surplus funds and provides great interest savings.

When your decisions are backed by a financial model, neither the banker nor the builder will be able to take undue advantage of you. Any claims they make can be validated by the model and refuted to get the best deal.

Tom was happy with the financial model we provided and was able to get the best deal from banker and builder. He also got insights on getting additional subsidy from schemes like PMAY from the banker. Now he keeps validating his loan account with the help of this calculator and ensures that there is no extra cost levied from him.